FintaxEasy was incorporated in 2021, by highly credentialed professionals with specialized experience across M&A Advisory, Operations & Risk Consulting, Asset Management, Financial Accounting, Audit and Process Re-engineering.

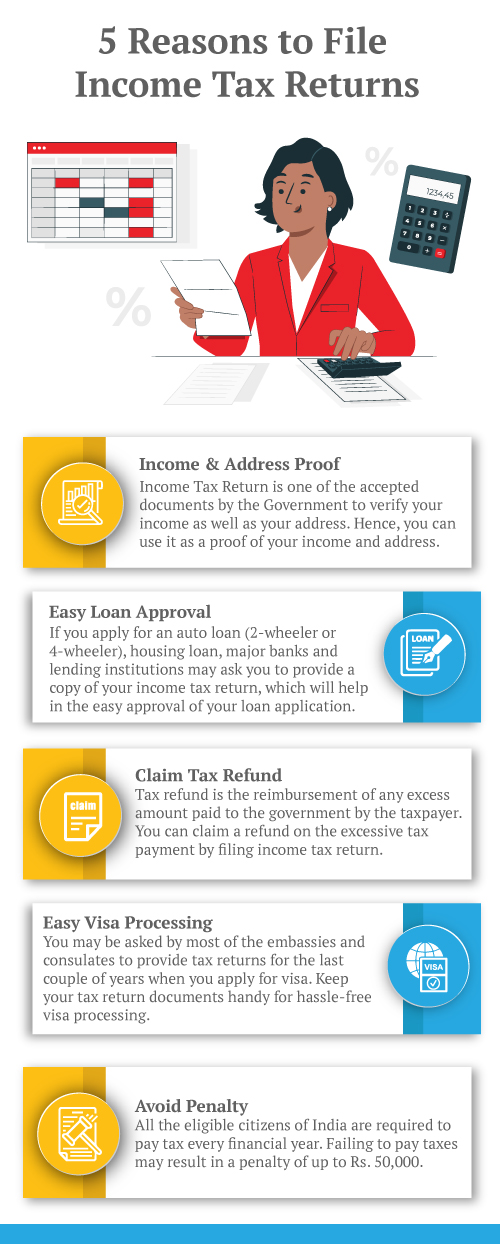

Income Tax Return (ITR) is a form that an individual submits to the Income Tax Department to file information about his income and taxes payable during that year. Information filed in an ITR should be applicable for a particular financial year between 1st April to 31st March of the next year. The income you earn can be from sources such as salary, profit in business, sale of house or property, dividend or capital gains, and interest received among others. If you have paid tax in excess during a year, you will get a refund by the Income Tax Department.

If you earn more than the limit that is exempted from being taxed by the Government, you are mandatorily required to file your tax return according to the tax slabs for each year. Filing your ITR post the due date may attract a penalty and also become a deterrent in getting a loan or visa approved in the future.

When you start the process of filing your income tax return, apart from your salary slips, bank savings account passbook, Aadhar card and PAN card, there are a few other documents that you will require to ease your tax filing process:

There are seven different types of ITR forms for different categories of individuals and source of income. The Income Tax Department has different forms for each taxpayer depending on the category of income generation:

| Section | Different Situations |

|---|---|

| 139(1)(a) | A company/firm is required to submit its return of income (regardless of the quantum of income or loss). |

| 139(1)(b) | A person (other than an individual/ HUF/company/firm) is required to submit his/its return of income, if income exceeds exemption limit. |

| 139(1)(b), read with fifth proviso | Individual/HUF is required to submit his/its return of income, if income [without claiming deduction under sections 10A, 10B, 10BA, 80C to 80U and under section 10(38)] exceeds the amount of exemption limit. |

| 139(4A) | A person in receipt of income derived from property held under a trust for charitable or religious purposes is required to submit return of income if its income (without giving exemption under section 11 or 12) exceeds exemption limit. |

| 139(4B) | Chief executive officer of every political party is required to submit income-tax return if income of the political party (without giving exemption under section 13A) exceeds exemption limit. |

| 139(4C) | If total income (without claiming any exemption given below) of the assesse (who is qualified to claim exemption under the following sections) exceeds the exemption limit- |

| 139(4D) | Any university/college/other institution referred to in section 35(1)(ii)/ (iii) is required to submit return of income (return has to be submitted whether there is income or loss. Such return has to be submitted even if it is not required by any other provision). |

| 139(4E)/(4F) | These sub-sections cover submimion of return by business trust/investment fund. |

| ITR Forms | Subject |

|---|---|

| ITR-1 (i.e., SAHAJ (a) | For an individual who is resident and ordinarily resident (total income does not exceed Rs. 50 lakh) having income from salary/one house property (not being brought forward loss or loss to be carried forward)/income from other sources (not being loss and not being winning from lottery/income from race horses). |

| ITR-2 | For an individual/HUF where the total income does not include income under the head business or profession |

| ITR-3 | For an mdividual/HUF having income under the head business or profession. |

| ITR-4 (i.e., Sugam) | For an individual/HUF/firm (other than LLP) deriving business income and such income is cornputed in accordance with special provisions referred to in section 44AD, 44ADA or 44AE |

| ITR-5 | For firms, AOPs and BOIs or any other person (not being individual or HUF or company or to whom ITR-7 is applicable) |

| ITR-6 | For companies other than companies claiming exemption under section 11 |

| ITR-7 | For persons including companies required to furnish return under section 139(4A)/(4B)/(4C)/(4D) |

| ITR-V | Where the data of the return of income in Forms ITR-1, ITR-2, ITR-3, ITR-4 and ITR-5 transmitted electronically without digital signature |